Imprudential Inc Has an Unfunded Pension

Imprudential Inc has an unfunded pension liability of 800 million that must be paid in 16 years. If the relevant discount rate is 52.

Solved Imprudential Inc Has An Unfunded Pension Liability Chegg Com

To assess the value of the firms stock financial analysts want.

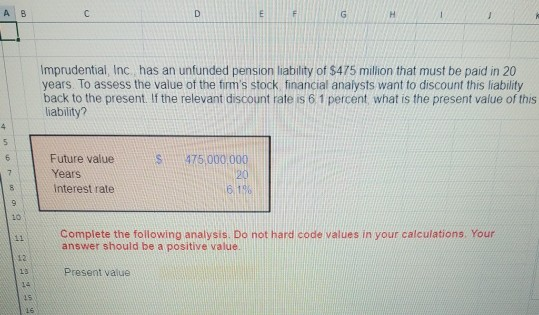

. If the relevant discount rate is 61 percent what is the present value of this liability. If the relevant discount rate is 95 percent what is the present value of this liability. Has an unfunded pension liability of 750 million that must be paid in 20 years.

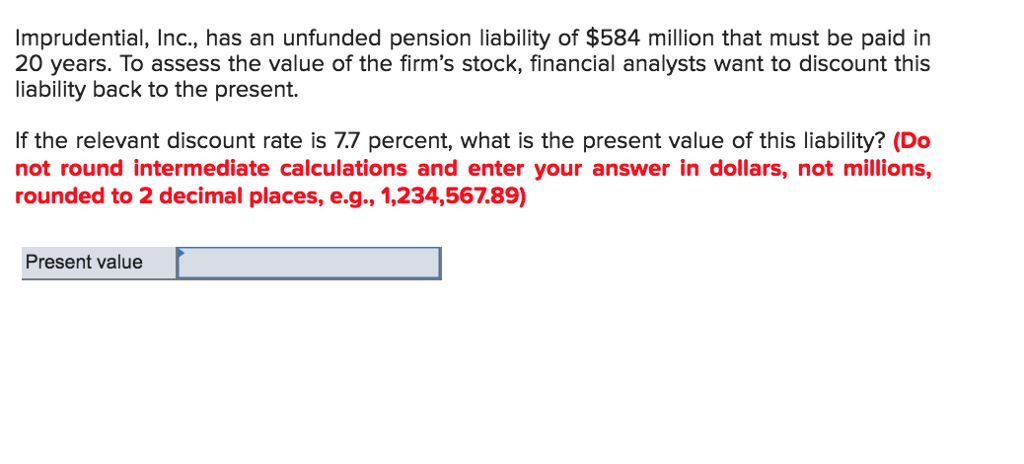

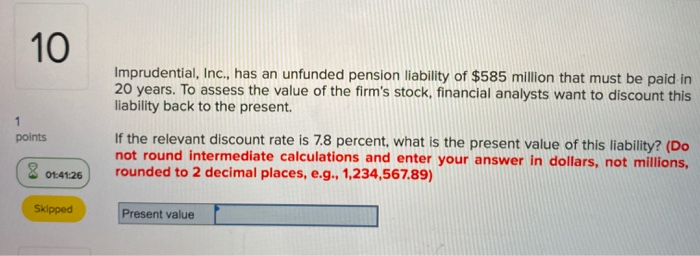

To assess the value of the firms stock financial analysts want to discount this liability back to the present. To assess the value of the firms stock financial analysts want to discount this liability back to the present. Imprudential Inc has an unfunded pension liability of 762 million that must be paid in 20 years.

To assess the value of the firms stock financial analysts want to discount this liability back to the present. To assess the value of the firms stock financial analysts want to discount this liability back to the present. To assess the value of the firms stock financial analysts want to discount this liability back to the present.

Imprudential Inc has an unfunded pension liability of 650 million that must be paid in 20 years. To assess the value of the firms stock financial analysts want to discount this liability back to the present. If the relevant discount rate.

Imprudential Inc has an unfunded pension liability of 800 million that must be paid in 16 years. Finance questions and answers. Imprudential inc has an unfunded pension liability of.

To assess the value of the firms stock financial analysts want to discount this liability back to the present. If the relevant discount rate is 8 percent what is the present value of this liability. Has an unfunded pension liability of 627 million that must be paid in 21 years.

To assess the value of the firms stock financial analysts want to discount this liability back to the present. Imprudential Inc has an unfunded pension liability of 768 million that must be paid in 15 years. Imprudential Inc has an unfunded pension liability of 475 million that must be paid in 20 years.

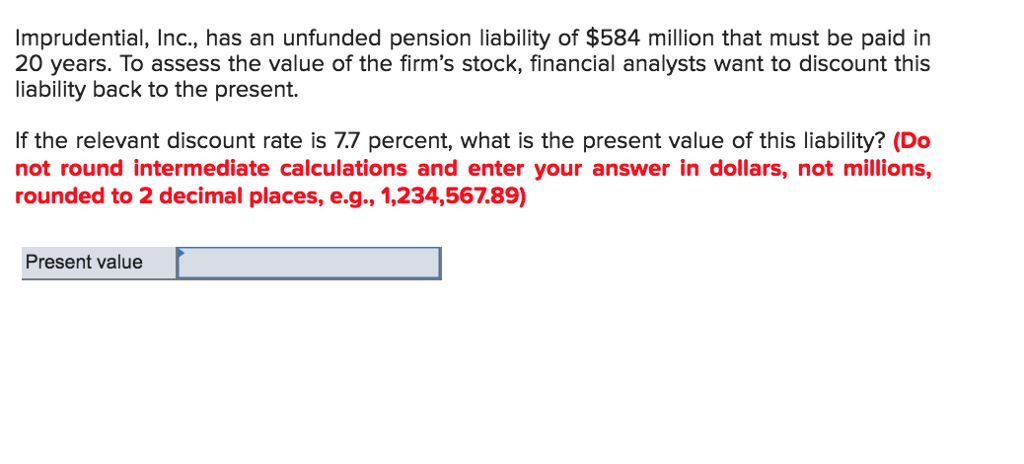

Imprudential Inc has an unfunded pension liability of 578 million that must be paid in 20 years. To assess the value of the firms stock financial analysts want to discount this liability back to the present. The relevant discount rate is 738 percent.

To assess the value of the firms stock financial analysts want to discount this liability back to the present. Has an unfunded pension liability of 415 million that must be paid in 20 years. To assess the value of the firms stock financial analysts want to discount this liability back to the present.

Do not round intermediate calculations and enter your answer in dollars not. To assess the value of the firms stock financial analysts want to discount this liability back to the present. Imprudential Inc has an unfunded pension liability of 756 million that must be paid in 30 years.

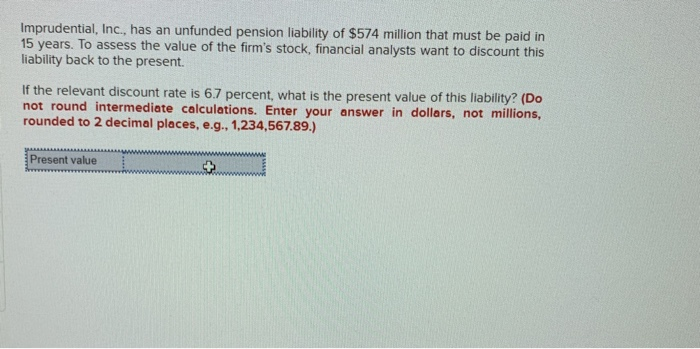

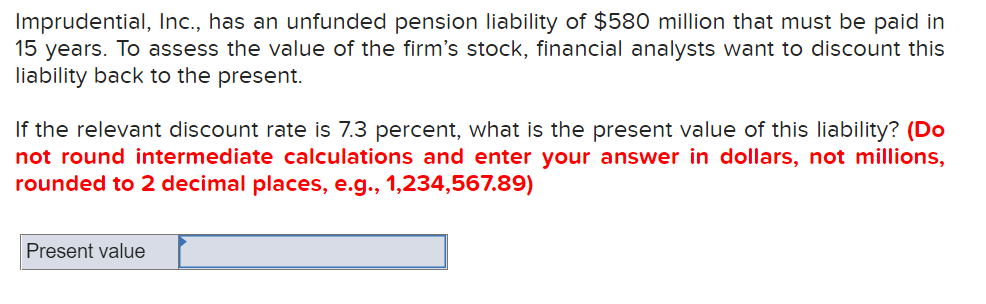

Imprudential Inc has an unfunded pension liability of 765 million that must be paid in 25 years. If the relevant discount rate is 8 percent what is the present value of this liability. Imprudential Inc has an unfunded pension liability of 574 million that must be paid in 15 years.

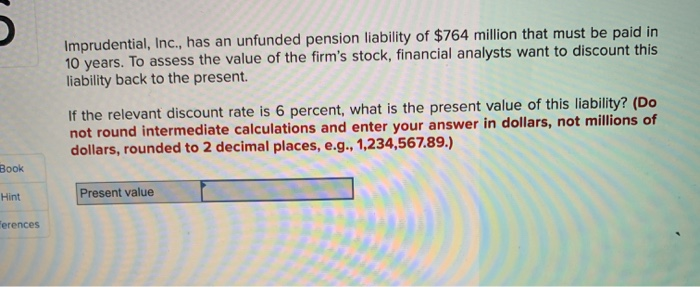

To assess the value of the firms stock financial analysts want to discount this liability back to the present. If the relevant discount rate is 6 percent what is the present value of this liability. The relevant discount rate is 52 percent.

If the relevant discount rate is. Finance questions and answers. Imprudential Inc has an unfunded pension liability of 567 million that must be paid in 20 years.

A 195316570 B 172286761. 4 5 5 7 Future value. To assess the value of the firms stock financial analysts want to discount this liability back to the present.

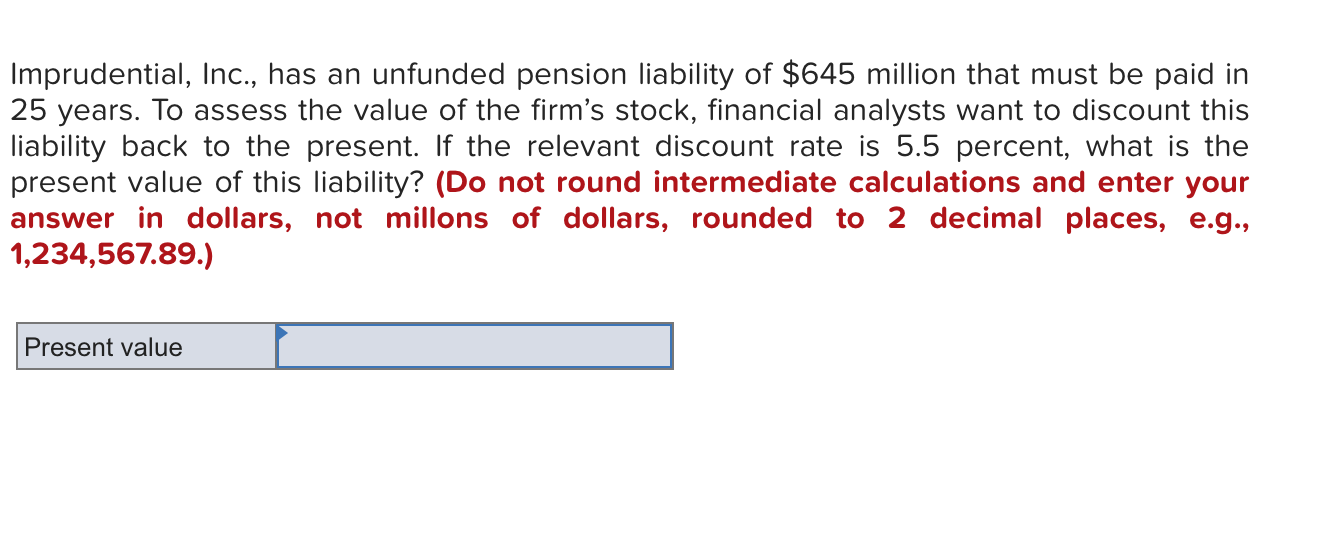

To find the PV of a lump sum we use. Imprudential Inc has an unfunded pension liability of 645 million that must be paid in 25 years. What is the present value of this liability.

Imprudential Incorporated has an unfunded pension liability of 450 million that must be paid in 20 years. To assess the value of the firms stock financial analysts want to discount this liability back to the present. Has an unfunded pension liability of 565 million that must be paid in 15 years.

If the relevant discount rate is 9 percent what is the present value of. If the relevant discount rate is 7 percent what is the present value of this liability. Has an unfunded pension liability of 750 million that must Imprudential Inc.

If the relevant discount rate is 55 percent what is the present value of this liability. To assess the value of the firms stock financial analysts want to discount this liability back to the present. Imprudential Inc has an unfunded pension liability of 645 million that must be paid in 25 years.

To assess the value of the firms stock financial analysts want to discount this liability back to the present. 2 on a question. To assess the value of the firms stock financial analysts want.

To assess the value of the firms stock financial analysts want to discount this liability back to the present. If the relevant discount rate is 85 what is the present value of this liability. If the relevant discount rate is 10 percent what is the present value of this liability.

Has an unfunded pension liability of 650 million that must be paid in 20 years. What is the present value of this liability. If the relevant discount rate.

Imprudential Inc has an unfunded pension liability of 755 million that must be paid in 25 years.

Solved 10 Imprudential Inc Has An Unfunded Pension Chegg Com

Solved Imprudential Inc Has An Unfunded Pension Liability Chegg Com

Solved Imprudential Inc Has An Unfunded Pension Liability Chegg Com

Imprudential Inc Has An Unfunded Pension Liability Of 579 Million That Must Be Paid In 25 Homeworklib

Imprudential Inc Has An Unfunded Pension Liability Of 415 Million That Must Be Paid In 20 Homeworklib

Solved Imprudential Inc Has An Unfunded Pension Liability Chegg Com

Solved Imprudential Inc Has An Unfunded Pension Liability Chegg Com

Solved Imprudential Inc Has An Unfunded Pension Liability Chegg Com

Solved Imprudential Inc Has An Unfunded Pension Liability Chegg Com

Comments

Post a Comment